Malaysian SMEs Aided with Economic Stimulus Package to Alleviate the Burden of Covid-19 Pandemic

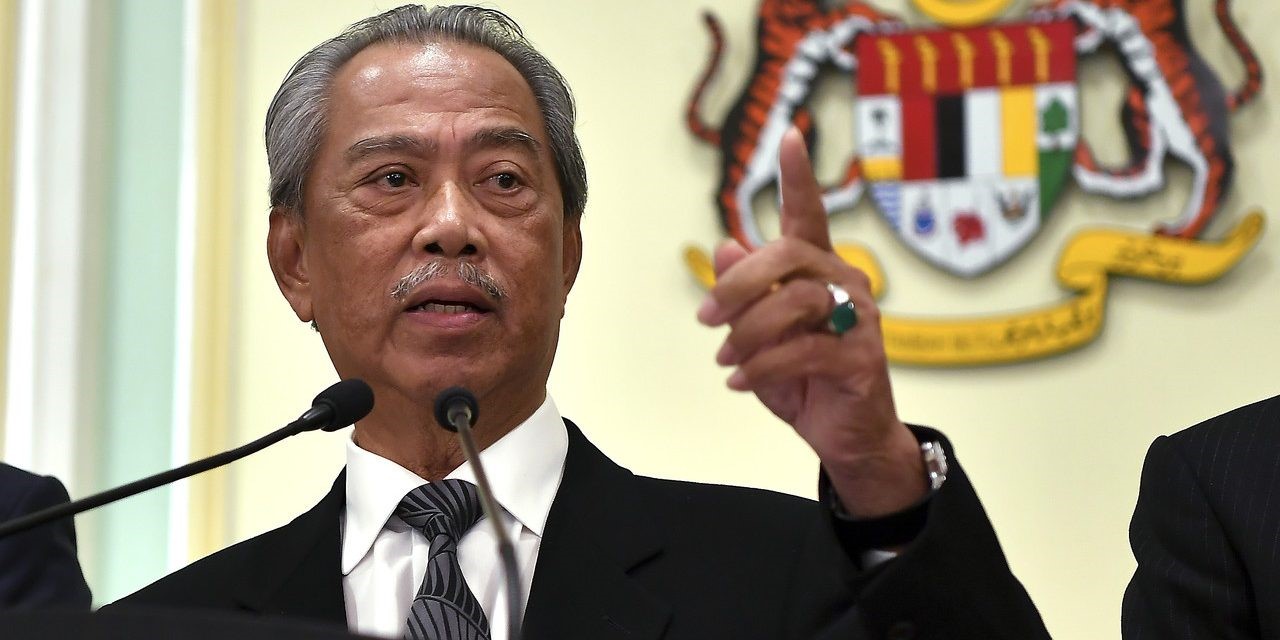

In response to a major increase in Covid-19 cases, Malaysian Prime Minister, Muhyiddin Yassin, announced that the nationwide movement restrictions or Movement Control Order (MCO) have been extended from March 13 to April 14. Initially, the government had announced a restriction period from March 18 to March 31, before finally extending it until April 14.

The Prime Minister addressed on Wednesday (March 25) that the government decided on the extension of border closures and shutdowns for non-essential businesses as infections have reached the highest number in Southeast Asia (as of Friday, March 27), which is 2,031 cases, with a number of deaths that has climbed to 24. This forces the government to continue the MCO for a longer period of time.

During the restriction period, structures where many people normally gather, such as places of worship and office buildings, are closed; except for supermarkets, grocery stores, or shops that sell people’s daily needs. To ensure effective implementation of the MCO, the government has carried out stern actions, including RM1,000 penalty and police arrests which lead to 6-month prison time.

To reduce the impact of Covid-19 towards the country’s economy, Malaysian government has announced an economic stimulus package worth RM250 billion (US$58 billion) on Friday (March 27). The stimulus package consists of special allowances for healthcare providers, one-off cash aid and microcredit scheme for small-and medium-size enterprises (SMEs). In total, RM128 billion will be spent on public welfare, RM100 billion will be used to support businesses, while RM2 billion will be used to strengthen the country's economy. The remaining included the initial RM20 billion economic stimulus package announced by then interim Prime Minister Mahathir Mohamad on February 27.

The initial package, themed “Bolstering confidence, stimulating growth and protecting jobs”, was aimed at tourism industry, as Mahathir said that the particular sector instantly suffers from an economic impact of COVID-19. To reduce the impact, the government will take a three simultaneous approach – first, to ease the cash flow of affected businesses; second, to assist affected individuals; and third, to stimulate demand for travel and tourism.

The 6-month period measures which will start in April include postponing the monthly income tax instalment payments for businesses in the tourism sector and allowing the affected companies to revise their profit estimates for 2020 with respect to monthly income tax instalment payments without penalty.

There is also a 15% discount on monthly electricity bills proposed for hotels, travel agencies, airlines, malls, conventions and exhibition centers. Moreover, an exemption of Human Resource Development Fund fees will be provided to hotels and travel-related companies. Hotels will also be spared from the 6% service tax between March and August 2020.

In addition, the government, through Bank Negara Malaysia (BNM) and Bank Simpanan Nasional (BSN), will offer financing facilities to affected companies in forms of loans / financing to individuals and SMEs as well as corporations. To ease the cash flow of individuals and SMEs that are likely to be the most affected by Covid-19, banking institutions will offer a postponement of all loan / financing repayments for a period of 6 months, effective from 1 April 2020.

As for credit card facilities, banking institutions will offer to convert the outstanding balances into a 3-year term loan with reduced interest rates to help borrowers manage their debt better. Banking institutions will also facilitate requests by corporations to postpone or restructure their loans / financing repayments so that corporations will be able to preserve jobs and conduct economic activities when conditions improve.

The second package, called “Prihatin Rakyat Economic Stimulus Package” consists of a special allowance of RM500 given to healthcare providers. The allowance will be allocated in two areas. The first one is RM400-600 monthly fund for doctors, nurses, and other healthcare staff; which will be provided continuously since April 1 until the pandemic ends. The second one is RM200 monthly fund for front liners, such as police, immigration and custom officers.

Furthermore, there is also RM10 billion one-off cash aid for middle-to-low citizens, such as fishermen, farmers, and small-and-medium size enterprises (SMEs) as well as people residing on Federal Land Development Authority (FELDA). The government also allocates RM350 million for electricity tariff reduction or discount.

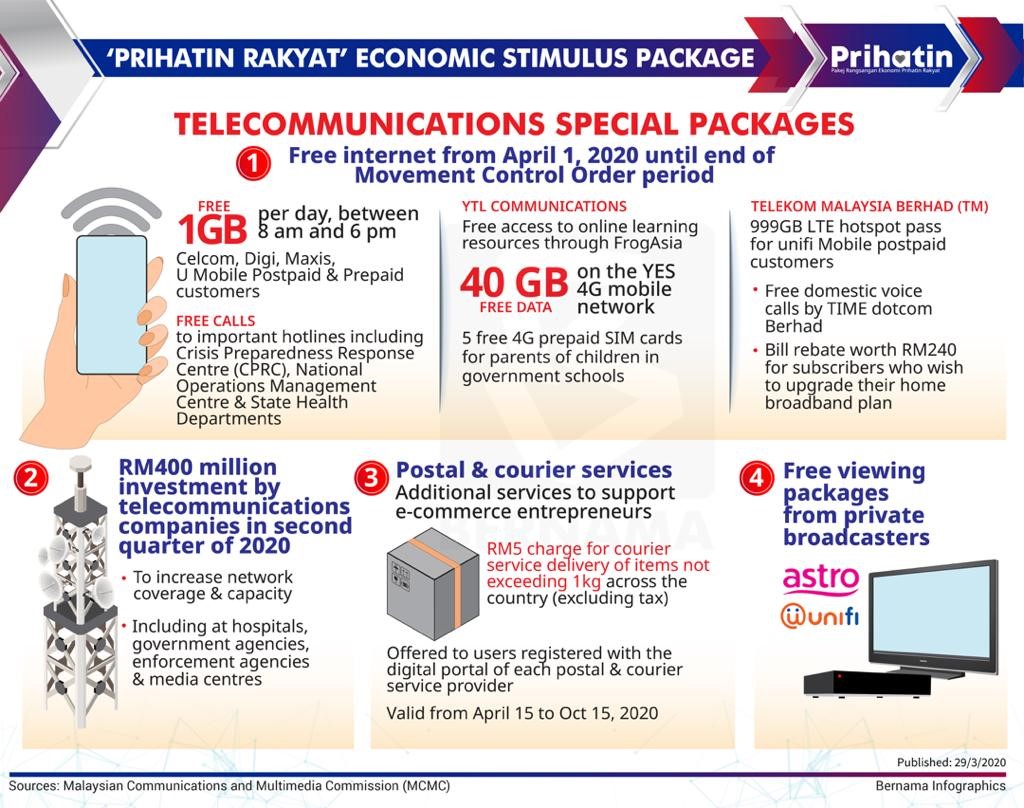

Another financial aid given by the government is an additional RM600 for workers with less than RM4,000 monthly income. Entrepreneurs with a minimum 50% loss of revenue since January 1, 2020 will also be given a special aid. Moreover, the government provides RM500 fund for 120,000 online drivers, prohibits companies to reduce employee salary with less than RM4,000 monthly incomes, and enables free internet network starting from April 1 until the end of the MCO program.

As there are pros and cons to most government regulations, the initiative has also not been greeted with a warm welcome by all. According to the President of SME Association of Malaysia, Datuk Kang, small and medium-sized enterprises (SMEs) do not benefit much from the new stimulus package. He said the industry was disappointed with the stimulus package and predicts that at least 50% of SMEs will close down.

He also expects up to four million people to lose their jobs. In Kang’s opinion, the stimulus package is good for the people, but not for businesses. He predicts that businesses may collapse as there is nothing much that would benefit the SMEs; he questions why SMEs have to take loans to pay salaries and rental when they have not got any income to sustain their businesses. Kang said SMEs were facing the burden of having to pay full salaries to workers as well as rental but did not have the financial resources to do so. Kang said the initiatives focused more on loans and credit, which were not much help to SMEs. He said the Special Relief Facility had very adamant criteria in order to obtain loans, and hopes that the government will look for alternative ways to assist SMEs survive.

As Mr. Muhyiddin mentioned in his speech on “Prihatin Economic Stimulus Package”, Malaysia is currently at war with invisible forces. This unprecedented situation of course requires unprecedented measures. Indeed, there are some glitches in the effort to overcome the nation’s problematic situation. However, there is one silver lining in the cloud. There is sufficient liquidity in the domestic banking system for the government to withdraw for the economic stimulus package without having to go to foreign markets and being exposed to currency risk. As a result, there is sufficient resource that can be used to finance disciplined government borrowing. Indeed, banks were reluctant to take up debts due to the low benefits. However, in times of national emergency, they have also shared their contribution.

One thing that needs to be addressed here is that the government must show financial discipline and be accountable. Despite financial concerns regarding SMEs and the government’s accountability, the fact that it has made massive funding initiatives to improve the scene has provided a small relief for people in operating their daily activities and assisted them in recovering financially during this crisis. In summary, it is with great expectation that Malaysia will soon have brighter days ahead.

Sources:

https://www.nst.com.my/opinion/columnists/2020/03/575187/covid-19-panic-and-malaysian-economy

https://www.nst.com.my/news/nation/2020/03/578956/pms-full-speech-prihatin-economic-stimulus-package

https://www.theedgemarkets.com/second-stimulus-package

https://vulcanpost.com/693631/malaysia-covid-19-economic-stimulus-smes/