UOB One Card

Annual Fee :

$193

Interest Rate :

25.90%

Minimal Income :

Citizen

Not Citizen

Apply now

at UOB Secure Site

Compare

UOB

$193

Available

21 days

25.90%

3% of S$50, whichever is higher

$40

$30,000

$40,000

S$90

2.80%

6%

Visa payWave, Apple Pay, Samsung Pay, Android Pay, Mighty Pay

Cash Back

- Up to 5% cash rebate on all spend for spend above S$2,000/month per quarter (up to 3.33% cash rebate for spend of $500 or $1,000 monthly)

- Up to 10% additional SMART$ rebate with UOB SMART$ Rebate Programme

Petrol

- At SPC Stations, up to 24% savings on fuel purchases

- At Shell Stations, up to 20.8% savings on fuel purchases

Grocery

- Up to 5% cash rebate on all spend each quarter (min. spend $2,000/month for all 3 months)

- Up to 3.33% cash rebate on all spend each quarter (min. spend $500/month or $1,000/month for all 3 months)

Dining

- Up to 5% cash rebate on all spend each quarter (min. spend $2,000/month for all 3 months)

- Up to 3.33% cash rebate on all spend each quarter (min. spend $500/month or $1,000/month for all 3 months)

- Enjoy up to 50% off with UOB dining privileges (e.g. 1-for-1 buffet at Marriott Café Buffet, Orchard Café and Café Mosaic)

Shopping

- Up to 5% cash rebate on all spend each quarter (min. spend $2,000/month for all 3 months)

- Up to 3.33% cash rebate on all spend each quarter (min. spend $500/month or $1,000/month for all 3 months)

- Up to 10% SMART$ rebate at over 400 merchants

Other Credit Cards

UOB Delight Card

Annual Fee :

$86

Interest Rate :

25.90%

Minimal Income :

* Citizen

$30,000

- Not Citizen

$40,000

Standard Chartered Platinum Visa/MasterCard Credit Card

Annual Fee :

$193

Interest Rate :

25.90%

Minimal Income :

* Citizen

$30,000

- Not Citizen

$60,000

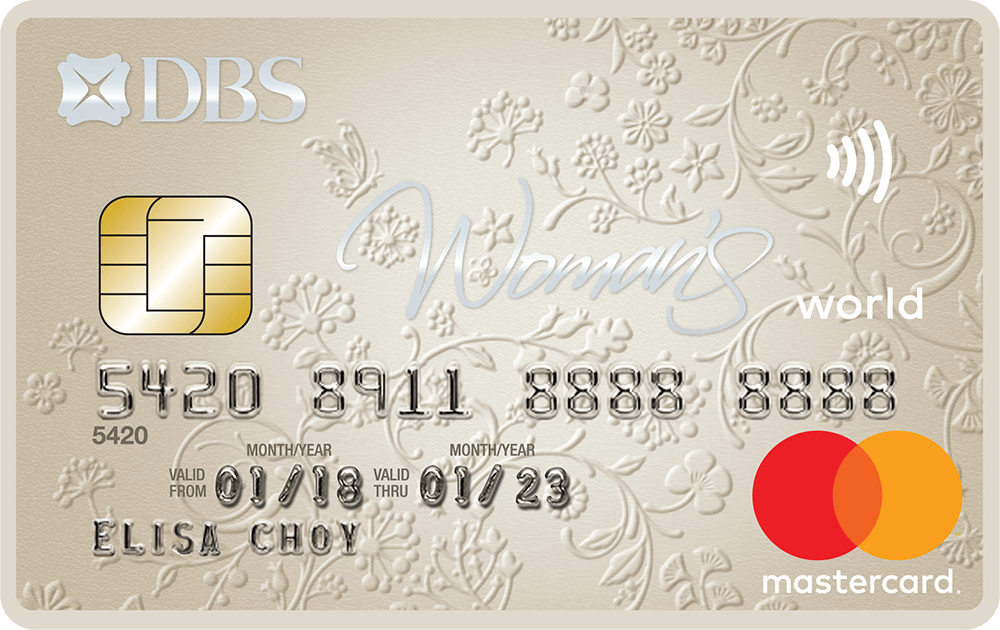

DBS Woman's World Card

Annual Fee :

$193

Interest Rate :

25.90%

Minimal Income :

* Citizen

$80,000

- Not Citizen

$80,000